Introduction

For international brands expanding into Japan’s e-commerce market, choosing between Amazon Japan and Rakuten Ichiba is a critical decision.

Yahoo! Shopping also plays a significant role domestically, particularly through its integration with the PayPay ecosystem, though it remains less accessible to overseas sellers.

Each platform offers distinct strengths in audience behavior, costs, and visibility.

This comparison highlights how they differ — helping you identify the marketplace best suited to your goals in Japan.

Marketplace Profiles

Amazon

- Entry & Reach: Low barrier to entry with fast onboarding; ideal for startups and cross-border sellers exporting to 67+ countries,

- Seller Fees: 8–15% commission; small sellers pay no monthly fee, larger sellers just ¥4,900/month,

- Buyer Appeal: Competitive pricing, convenient Prime shipping, and strong trust. Amazon’s user base skews slightly male (~60%), with younger users more likely to shop via smartphone.

- Market Size: ~67 million monthly users; ¥6 trillion GMV annually.

Rakuten (also known as “Rakuten Ichiba”)

- Tools & Loyalty: In-depth analytics, point-based promotions, and strong integration with other Rakuten services (Card, Travel, Mobile). Rakuten’s loyalty ecosystem is deeply embedded in Japanese daily life — over 31 million Rakuten Credit Cards have been issued (as of 2024), and 100 million+ domestic members participate in its Loyalty Points program. This drives exceptionally high repeat-purchase behavior.

- Seller Fees: Initial setup fee of ¥60,000 and monthly subscription between ¥19,500–¥100,000, depending on plan. On top of this, Rakuten charges multiple system and service fees — including checkout handling, point program participation, and Rakuten Messe (0.5%) — bringing the total effective cost closer to 10–15% for most sellers.

- Buyer Appeal:

Rakuten’s audience skews slightly female (~51%), performing strongly in categories like cosmetics, interior, and lifestyle. - Market Size: ~66 million monthly users; ¥5.6 trillion GMV annually.

Yahoo! Shopping

- Seller Fees:: No initial or monthly subscription fees.

However, sellers pay transaction and promotional fees (1–15%), and participation in PayPay and other campaigns can raise the effective cost slightly for competitive categories. - Discovery Power: Linked with Yahoo! Japan and PayPay, enhancing search and promotional visibility.

- Market Size: ~35 million users; ¥1.5 trillion GMV annually.

Usage Trends

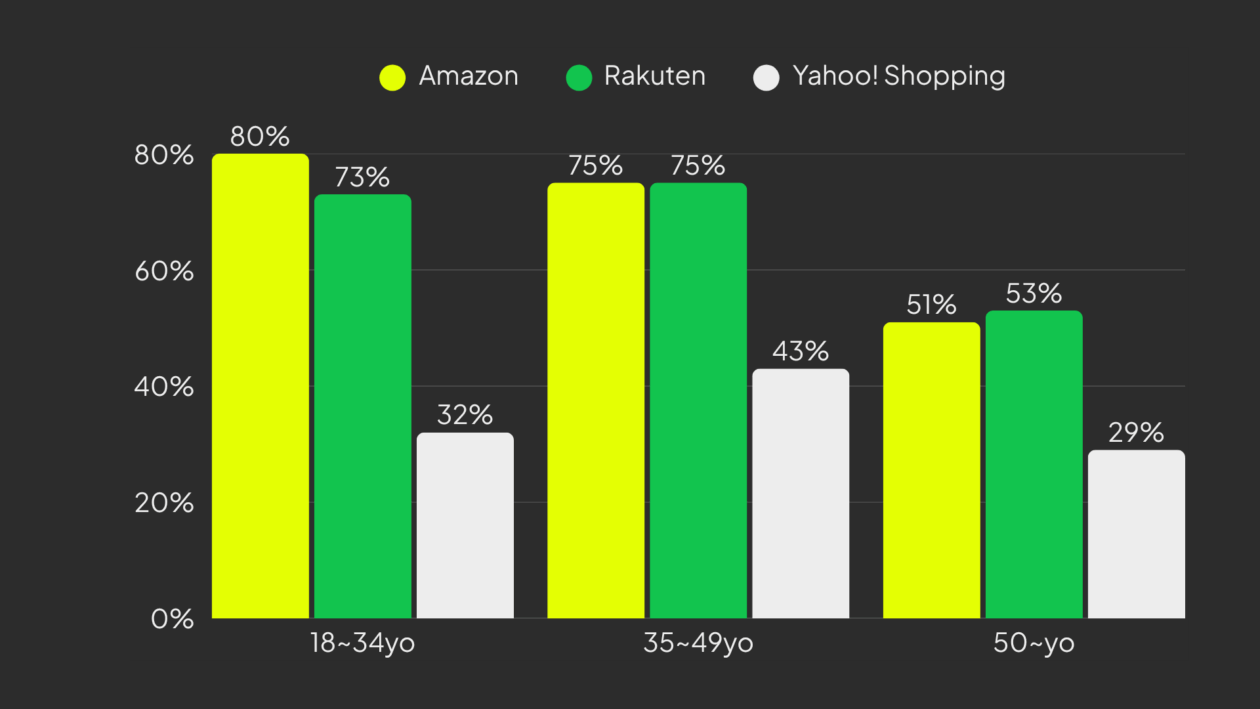

Both Amazon and Rakuten reach roughly 75–80% of Japanese consumers — with Amazon leading among users under 34, and Rakuten performing stronger among shoppers over 50.

Source: Nielsen, July 2025.

Japan e-commerce marketplace comparison

| Factor | Amazon | Rakuten | Yahoo! Shopping |

| User Base | 67 M | 66 M | 35 M |

| Turnover | ¥6T ($40 B) | ¥5.6T ($37 B) | ¥1.5T ($10 B) |

| Setup Fees | None | ¥60K | None |

| Monthly Fees | ¥0–¥4.9K | ¥19.5K–¥130K | None |

| Commission | 8–15% (category-based) | ~8–16% total (commission + checkout + points + Rakuten Messe) | 1–15% (PayPay-linked) |

| Fulfillment | FBA | Super Logistics* | Not provided |

| Advertising | Amazon Ads | Rakuten Marketing Platform | Yahoo! Ads |

| Cross-Border Friendliness | Yes (ACP process well integrated) |

Limited (ACP process applicable) |

No |

*A Japanese importer, or local legal entity is required by default for Rakuten Super Logistics. However, Rakuten has announced on Sept. 20, 2025 that the list of countries allowed to open shop on Rakuten Ichiba without having a Japanese entity has expanded to 22 countries (https://corp.rakuten.co.jp/news/press/2025/0930_03.html): New since September 2025: Belgium, Finland, New Zealand, Norway, Sweden, Switzerland. Previously possible: Australia, Austria, Canada, China, Denmark, France, Germany, Hong Kong, Italy, the Netherlands, Singapore, South Korea, Spain, Taiwan, the UK, and the US.

User Behavior Insights

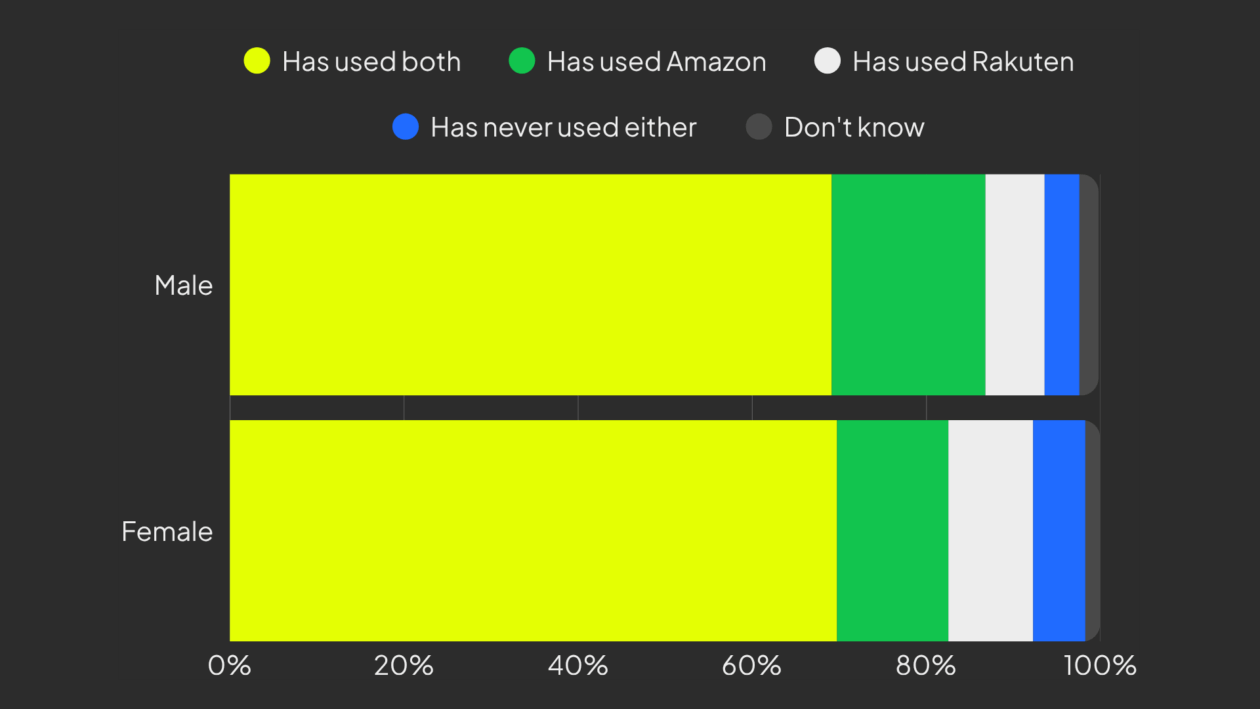

Around 70% of users shop on both Amazon and Rakuten. Younger shoppers favor Amazon, while women slightly prefer Rakuten.Overall, Amazon is used more often, especially by men and younger buyers.

Source: Nyle, July 2023. https://prtimes.jp/main/html/rd/p/000000375.000055900.html, sample size 1,099

Buyer-Focused Features

| Factor | Amazon | Rakuten | Yahoo! Shopping |

| Pricing | Generally lowest | Varies by store | Competitive |

| Loyalty Program | Amazon Prime | Rakuten Points | PayPay-linked rewards |

| Credit Card Benefits | Amazon Mastercard (SMBC); limited ecosystem | Rakuten Card (up to 5%, 31 M+ issued in 2024 | PayPay Card (5–7%) |

| Major Sales Events | Prime Day, Black Friday, etc. | Rakuten Super Sale, Shopping Marathon | PayPay Super Festival |

Key Takeaways

- Amazon: Best for sellers looking for quick setup and access to a broad customer base with minimal upfront cost. Easy cross-border with the ACP + FBA process.

- Rakuten: Suitable for established businesses seeking branding control, loyal users, and long-term growth tools. No easy cross-border scheme (cross-border must involve a local importing partner or 3PL).

- Yahoo! Shopping: Ideal for startups or budget-conscious brands looking for zero fixed costs and strong search engine visibility.

Looking to Expand Your E-Commerce Strategy in Japan?

At Next Level, we help brands navigate Japan’s e-commerce platforms, leverage native advertising tools, and optimize sales channels to match their growth goals. Whether you’re entering the market or seeking deeper insights into your existing marketplaces, our team will guide you every step of the way.