Navigating Japanese customs procedures can be complex and time-consuming. Next Level’s Attorney for Customs Procedures (ACP) services ensure that your imports comply with all Japanese customs regulations, so that your products reach your Japanese customers smoothly.

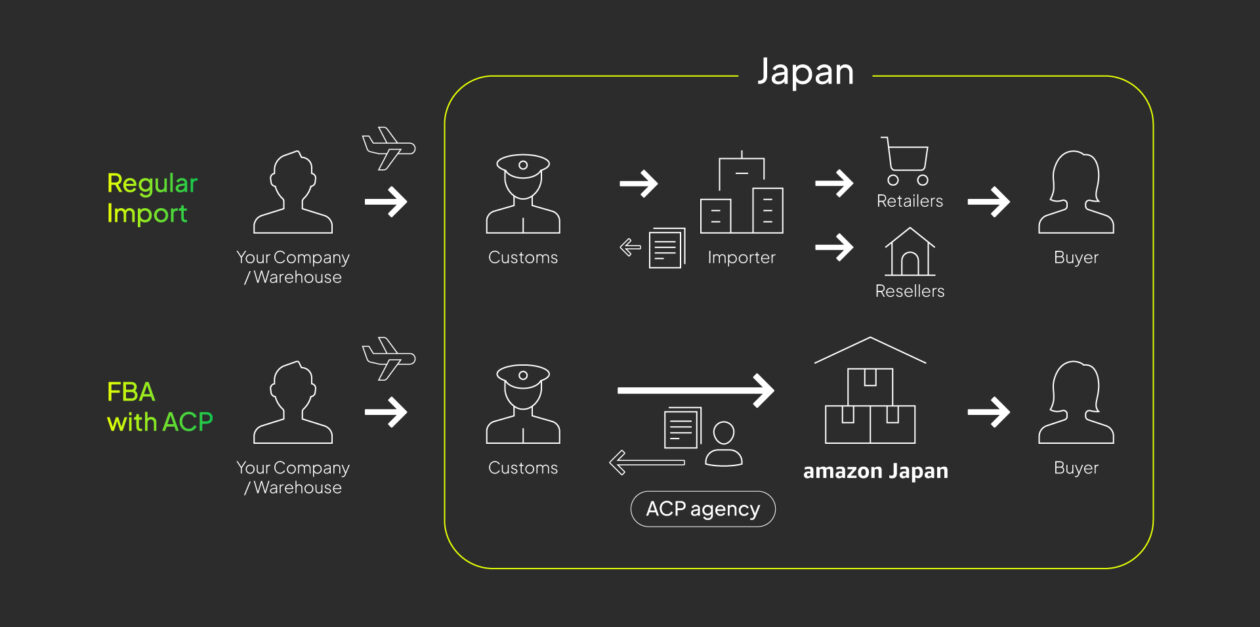

Amazon and Rakuten are Japan’s largest e-commerce marketplaces. But before you can start selling, unless you have an importer in the country, you need to understand the basics of Japan’s customs regulations.

This is where an Attorney for Customs Procedures (ACP) comes in. At Next Level, we act as your trusted representative, ensuring every step of your customs procedures is managed smoothly, accurately, and in full compliance with Japanese laws.

Whether you’re shipping your first product or scaling up your operations, Next Level is here to simplify the process for you.

An Attorney for Customs Procedures (ACP) is a certified representative authorized to handle customs formalities on your behalf in Japan. It is a legal requirement for businesses that do not have a local importer (more on this below). This service is essential for:

At Next Level, we take care of these tasks professionally, allowing you to focus on selling your products with confidence.

“ When any person living abroad / any company located abroad conducts customs clearance in Japan, they shall designate an ACP (Attorney for Customs Procedure) to do the work by proxy, filling in and submitting a predetermined form to the competent customs office, in advance.

In this case, to the extent of being entrusted as an attorney, the ACP shall file the export/import declaration, witness inspections, pay customs duties etc., and receive documents and tax refund from the customs office on behalf of the person living abroad or the company located abroad.

The ACP shall be a person who has address or residency in Japan (in the case of a corporate person, headquarters or major branch office in Japan). In the case where clearance procedures performed by a customs manager correspond to the operations stipulated in Article 2 of the Law of Customs Brokerage, the customs manager shall be required to obtain a brokerage license.”

(Article 95 of the Customs Law, Article 2 and Article 3 of the Law of Customs Brokerage)

Q: Can I use ACP services without having a legal entity in Japan?

A: Yes, you can. Our ACP services are designed to assist both domestic and international businesses, regardless of their legal presence in Japan.

Q: Can’t I just use Amazon FBA instead?

A: Amazon FBA is a warehousing and shipping service. Amazon’s FBA service does not handle customs clearance in Japan. If you do not have an importer, you must have an ACP process in place that will combine with your FBA, so that your products clear Customs and reach Amazon’s FBA warehouses effortlessly.

Q: Does Next Level handle restricted or regulated products?

A: Certain products may require additional checks or permits. Contact us, and we’ll guide you through the requirements.

Q: How much do ACP services cost?

A: Costs depend on factors like shipment frequency and product category. Contact us for a personalized estimate.

Q: Is ACP different from IOR?

A: Yes, they are different. Your ACP handles customs-related formalities and documentation on your behalf (the Seller). The ACP never owns your products. In contrast, IOR (Importer of Record) takes full legal responsibility for the imported goods, including compliance with import regulations and payment of taxes and duties. While ACP focuses on managing customs procedures, IOR is responsible for the overall import process.

Q: What about Japanese Consumption Tax?

A: Import Consumption tax is actually not paid by the ACP, it is added to your logistics bill, and paid directly by your courier company upon physical custom clearance.

Besides your import Consumption Tax, keep in mind that if one the items below applies to you, you also need to register with the Japanese tax authorities, submit a Consumption Tax declaration, and pay the relevant amount by yourself:

or:

For detailed information about Japan’s Consumption Tax regulations, please visit the official National Tax Agency page here.

Make your exports to Japan frictionless with Next Level’s Attorney for Customs Procedures (ACP) services.

| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |